Home Equity Conversion Mortgage for Home Purchase (H4P)

If your goal is to right size your housing needs by purchasing a new home instead of accessing the equity in your current home, one way to do so is to utilize a HECM for Home Purchase (also known as an H4P, Reverse For Purchase and Purchase HECM).

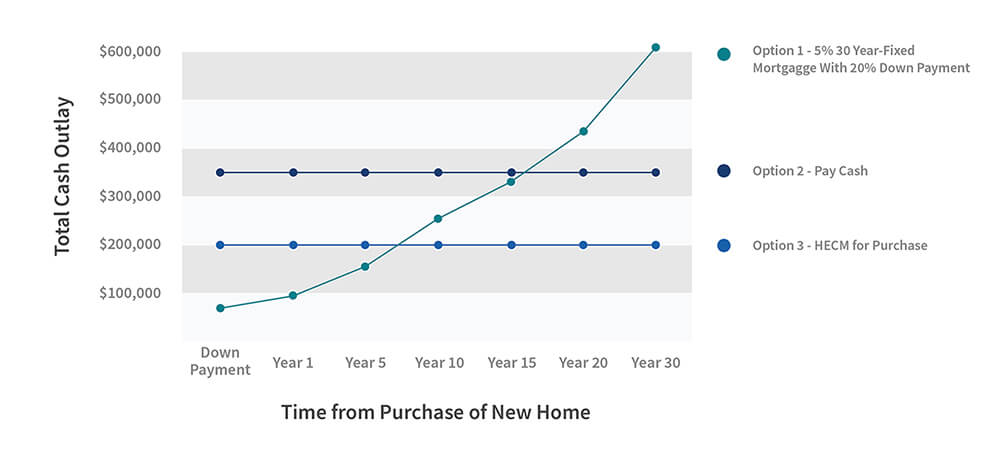

This means utilizing a HECM loan on the home you are buying instead of having to qualify for a traditional mortgage. When you utilize a Purchase HECM, your HECM funds are paid in a lump sum directly to the seller at the close of escrow – just like with a traditional mortgage. However, the big difference is that you will never be required to make monthly loan payments for as long as you live in your new home** and continue to satisfy loan conditions. Loan requirements include home maintenance and payment of property taxes, homeowner’s insurance, and any HOA fees.

The Purchase HECM is ideal for those who want to purchase the best home for their retirement needs – without impacting their monthly cash-flow by taking on another monthly payment obligation.