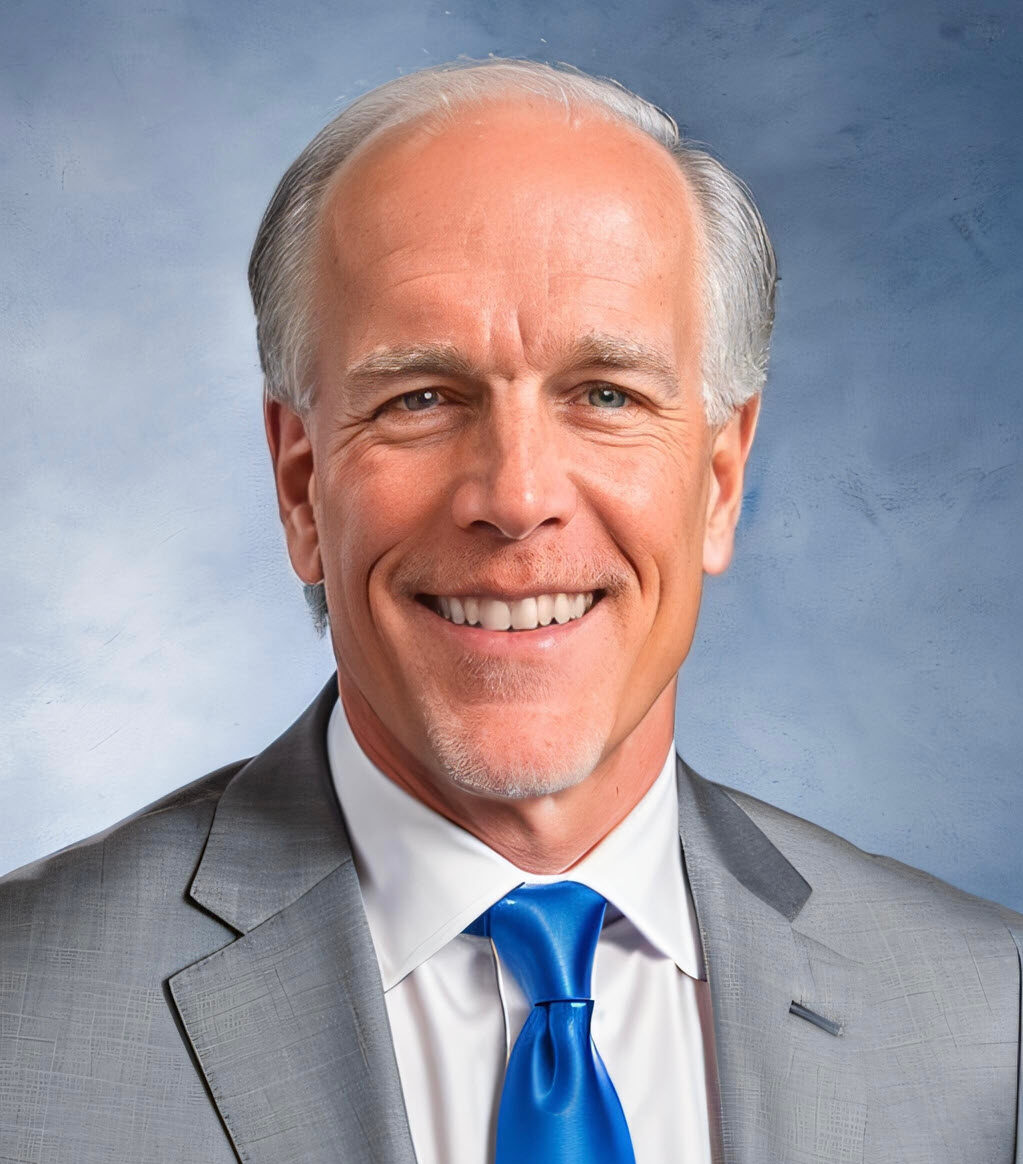

About David Garrison

I’m David Garrison, a Reverse Mortgage Loan Officer with Mutual of Omaha Mortgage. My journey into the world of reverse mortgages is deeply personal and rooted in both experience and a strong belief in the untapped potential of home equity.

Background and Experience

With a career spanning more than thirty years in sales and business management, I’ve had the privilege of navigating the complexities of various industries. This culminated in the successful sale and retirement from my own company after 36 years. This extensive experience has not only honed my business acumen but also ingrained in me the importance of trustworthy, client-focused service.

Personal Connection to Reverse Mortgages

My advocacy for Home Equity Conversion Mortgages (HECMs), more commonly known as reverse mortgages, is not just professional; it’s personal. Several years ago, I advised my mother to opt for a reverse mortgage, which proved to be a wise decision as it significantly aided her in her later years. My wife, Carol, and I have also embraced this financial tool, seeing it as a prudent hedge against the unpredictable nature of future market returns.

I firmly believe that the equity in one’s home is a valuable yet often overlooked asset that should be strategically utilized, especially for us baby boomers, as part of a comprehensive retirement plan.

Community Engagement

Giving back to the community has always been a cornerstone of my life. My volunteer work with organizations such as Habitat for Humanity, Kairos Prison Ministry, and CareNet Pregnancy Centers reflects my commitment to making a positive impact on the lives of others. Locally, I’ve been actively involved in supporting the retirement community by delivering meals to seniors in need through the St Vincent DePaul Society and sharing my knowledge of reverse mortgages at senior centers in Martinsville and Mooresville, Indiana.

Additionally, my roles with the St Vincent De Paul Society, Kairos Prison Ministries, The Better Communities Coalition of Morgan County, and as a board member of Clarity of Central Indiana, allow me to contribute to the well-being of our community in meaningful ways.

Personal Interests

When I’m not assisting clients or volunteering, I cherish the time spent traveling, especially cruising and sailing. I’m also an avid reader, musician, and a member of both church and prison music groups. These passions not only enrich my life but also keep me connected to diverse communities and perspectives.

Why I Chose This Path

My decision to specialize in reverse mortgages at Mutual of Omaha Mortgage is deeply influenced by the positive impact it has had on my family’s financial planning and our ability to contribute to causes we care about. I am committed to helping others understand how a reverse mortgage can fit into their retirement planning, providing security, peace of mind, and the opportunity to live a more fulfilling life.

I look forward to the opportunity to share my insights and experiences with you and to explore how a reverse mortgage might benefit your retirement strategy.

I am licensed to originate reverse mortgage loans in Indiana and Michigan.

To get started, fill out the form on this page or give me a call at 317-644-2595.