Two common ways homeowners tap into their home equity are through a HECM (Home Equity Conversion Mortgage) loan or a HELOC (Home Equity Line of Credit) loan. They both provide financial relief, but they work in very different ways and are intended for different financial situations.

Understanding which option fits into your financial goals is key to making a confident, informed decision; one that will bring financial peace, not financial stress.

HECM Explained: What Is a HECM loan?

A HECM loan is a government-insured reverse mortgage loan designed for homeowners aged 62** and older. It allows homeowners to access home equity without selling the home or making monthly mortgage payments*.

Benefits of a HECM:

- No monthly loan payments* required.

- Flexible disbursement options: lump sum, monthly income, or line of credit.

- Can provide financial stability during retirement.

- Federally insured by the Federal Housing Administration (FHA). As of 2026, the lending limit is set at $1,249,125. Visit the FHA Mortgage Limits Lookup Tool for more information.

Considerations:

- Interest accrues over time, reducing home equity.

- Upfront costs can include fees and mortgage insurance.

- Loan repayment is triggered when the homeowner sells, moves out, or passes away.

- Home upkeep and taxes continue to be the homeowner’s responsibility.

HELOC Explained: What Is a Home Equity Line of Credit?

A HELOC is a revolving line of credit based on the equity in your home. It’s commonly used for home improvements, education expenses, or emergency funding.

Benefits of a HELOC:

- Borrow only what you need, when you need it

- Interest-only payments during the draw period

- Typically lower interest rates than credit cards

Considerations:

- Monthly payments* required after the draw period

- Variable interest rates can increase costs over time

- Requires good credit and income for approval

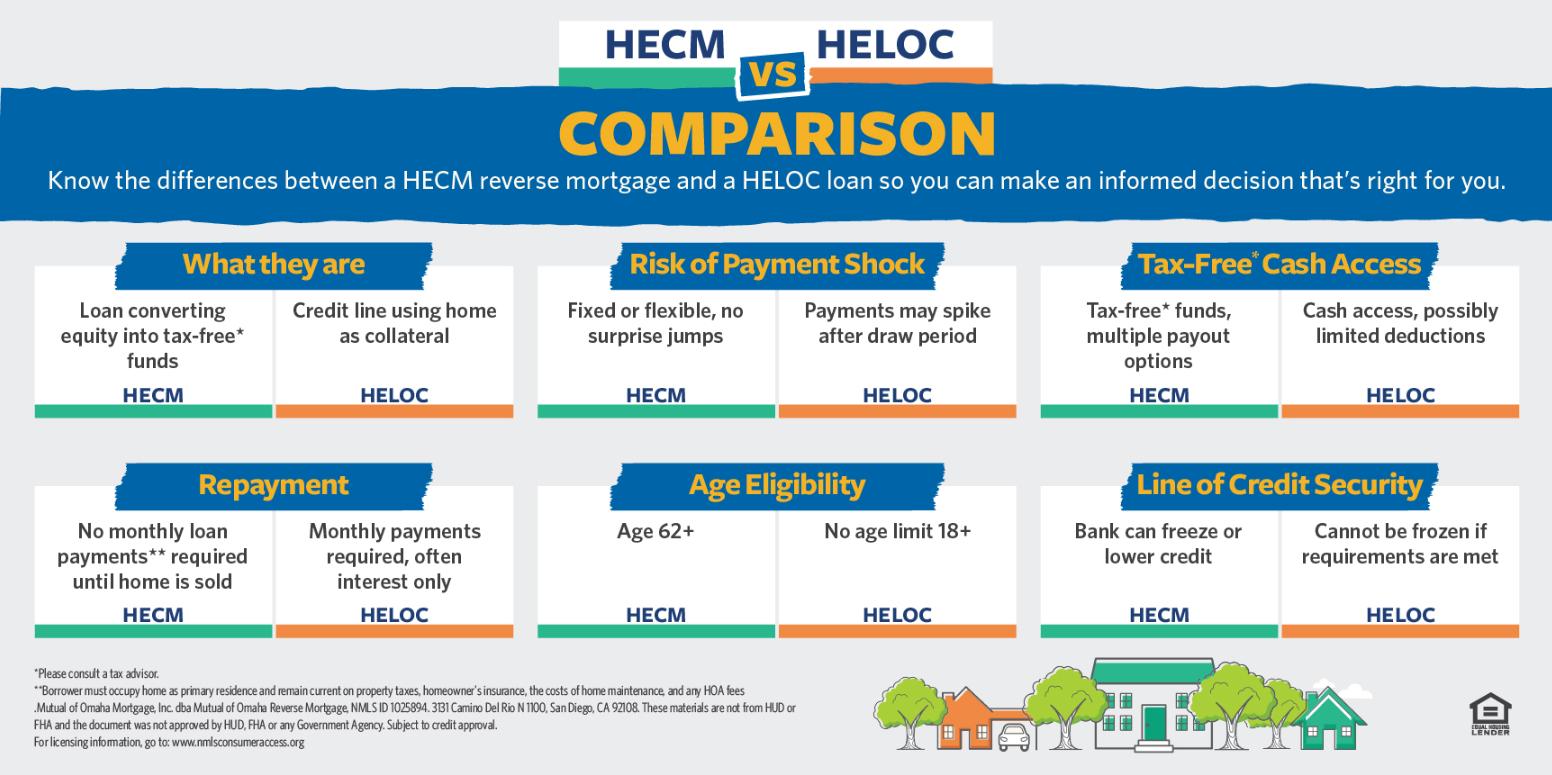

HECM vs. HELOC: Side-by-Side Comparison

Which Option Is Better for You?

For Retirees Seeking Income Stability

A HECM loan may be ideal if you’re retired and want to stay in your home while accessing cash without monthly payments*.

For Homeowners Needing Flexible Access

A HELOC is better suited for short-term borrowing needs like renovations or unexpected expenses, especially if you’re still working.

For Estate Planning

HECMs reduce home equity, potentially affecting inheritance. HELOCs preserve equity only if repaid responsibly.

HECM vs. HELOC in Action

Susan’s Story – Choosing a HECM

At 68, Susan owned her home outright and had always taken pride in maintaining her independence. But as healthcare costs began to rise, she found herself needing extra income to cover medical bills and ongoing care. Selling her home wasn’t an option—she loved her neighborhood and the memories tied to her house.

That’s when Susan learned about a Home Equity Conversion Mortgage (HECM). It allowed her to tap into the value of her home without having to move or take on monthly loan payments*. The funds she received helped ease her financial stress and gave her the flexibility to manage her healthcare needs comfortably.

With a HECM, Susan was able to stay in the home she loved while gaining the financial support she needed—without adding a monthly burden to her fixed retirement income.

John’s Story – Choosing a HELOC

At 45, John had big plans for his home. His kitchen, once charming, was now outdated and inefficient. After exploring his options, he decided to use a Home Equity Line of Credit (HELOC) to borrow $30,000 for a full renovation.

The process was smooth. With the funds available, John hired a contractor, upgraded his appliances, and transformed the space into a modern, functional kitchen. He appreciated the flexibility of the HELOC, which allowed him to borrow only what he needed and repay it over time.

John was fortunate—he was still working full-time and had a stable income, so the monthly payments fit comfortably into his budget. But he knew the repayment terms would eventually shift, and he’d need to pay both principal and interest. He made a plan to pay off the balance before retirement to avoid financial strain later.

John’s story shows how a HELOC can be a helpful tool—as long as you understand the long-term commitment and have a strategy to manage payments, especially before transitioning to a fixed income.

Buyer’s Guide: Questions to Ask Before Choosing Between HECM and HELOC

- Do I plan to stay in my home long-term?

- Do I meet the age requirement for a HECM?

- Am I comfortable with monthly payments?

- How much equity do I have in my home?

- What are the fees and interest rates?

- How will this affect my financial future and estate planning?

Final Thoughts

Both HECMs and HELOCs offer a valuable option to access home equity, but they serve different needs. A HECM is well-suited for older homeowners who want to access their home equity without taking on monthly payments*, making it a practical option for those on a fixed income. In contrast, a HELOC offers flexible access to funds but requires regular payments, which may be more manageable for homeowners who are in a position to make monthly payments.

Before making a decision, consult a financial advisor and compare offers from multiple lenders. Understanding your goals and financial situation will help you choose the option that best supports your financial goals.

* Borrower must occupy home as primary residence and remain current on property taxes, homeowner’s insurance, the costs of home maintenance, and any HOA fees.

** Due to state restrictions, some states have a higher minimum age than 55.

Reverse mortgage borrower must occupy home as primary residence and remain current on property taxes, homeowner’s insurance, the costs of home maintenance, and any HOA fees.

This information is intended to be general and educational in nature and should not be construed as financial advice. Consult your financial advisor before implementing financial strategies for your retirement.