Introducing SecureEquity: A Smarter Way to Access Your Home's Value

Learn More →

For

Purchase

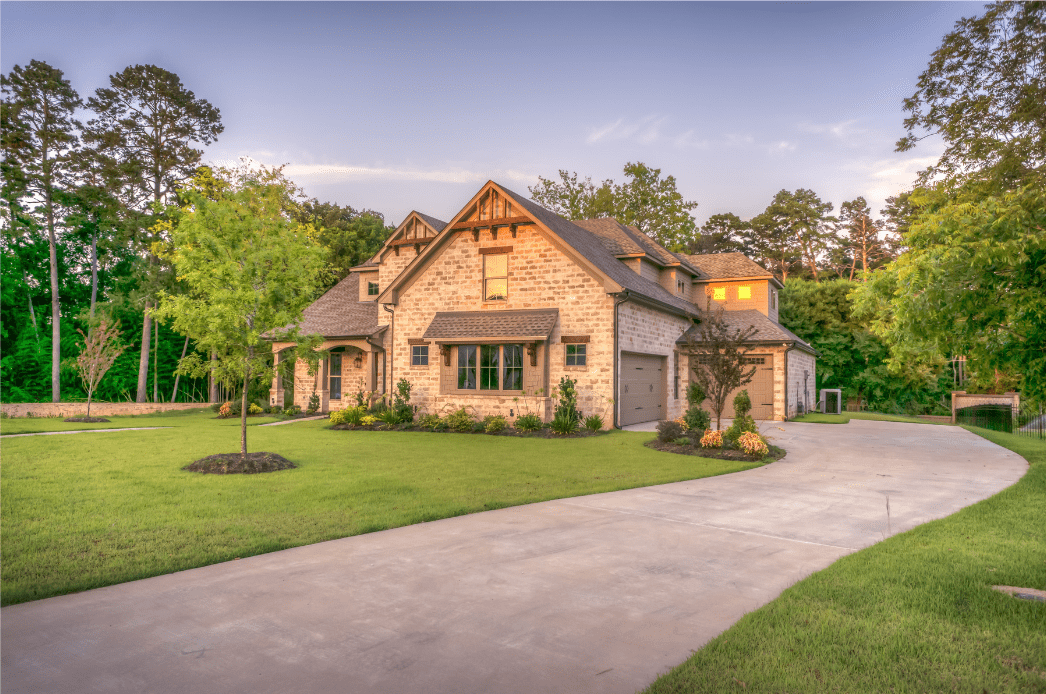

Buy Your Dream Home Without Sacrificing Financial Security

What is HECM for Purchase?

Are you 62 or older and considering a new home? The Home Equity Conversion Mortgage (HECM) for Purchase is a powerful financial tool that allows you to buy a home without monthly mortgage payments while keeping more money in your pocket.*

Whether you're looking to downsize, move closer to family, or find a home better suited for retirement, HECM for Purchase helps you achieve your homeownership goals with financial flexibility.

What are the benefits?

- Buy the retirement home you truly want—without stretching your budget.**

- Enjoy no required monthly mortgage payments, freeing up cash for other expenses.*

- Preserve your retirement savings and maintain greater financial flexibility.

- Benefit from flexible repayment options—pay as much or as little as you choose each month.

How Does a HECM for Purchase Work?

-

1You make a one-time down payment (typically using proceeds from selling your current home or savings).

-

2The reverse mortgage covers the remaining cost—meaning no monthly principal or interest payments are required.*

-

3You continue to own your home, and the loan is repaid only when you sell, move out, or pass away.***

What Can You Use HECM For Purchase For?

HECM for purchase offers financial flexibility, allowing you to:

-

Right-size for retirement – Downsize or upsize to a home that better fits your needs.

-

Relocate to a desired area – Move closer to family, enjoy better weather, or settle in a senior-friendly community.

-

Improve financial security – Keep more cash in savings, preserve investments, and enhance monthly cash flow.

-

Enjoy a maintenance-free lifestyle – Purchase a condo, townhome, or home in a 55+ community with lower upkeep.

-

Plan for the future – Secure stable housing, free up funds for retirement goals, and maintain homeownership with equity for heirs.

How Much Home Can You Afford?

Let's take a look at an example:

Jim and Sally, both 75, are selling their current home for $400,000 to move closer to their son.

| Scenario | Downsize | Upsize |

|---|---|---|

| Cash after sale | $400,000 | $400,000 |

| Cost of new home | $300,000 | $600,000 |

| Cash required to close | $161,459 | $319,479 |

| Cash remaining after purchase | $238,541 | $80,521 |

Now, Jim and Sally live in a brand-new home with NO monthly mortgage payments* and have extra cash left over for retirement!

* Borrower must occupy home as primary residence and remain current on property taxes, homeowner’s insurance, the costs of home maintenance, and any HOA fees.

** Borrowers must meet eligibility requirements and continue to pay property taxes, homeowners insurance, and home maintenance costs.

*** Repayment is deferred as long as the borrower (or eligible non-borrowing spouse) meets loan requirements, including maintaining the home as their primary residence and keeping property charges current.