Shifting Into Reverse Blog

#18 Postponing Plan Withdrawals Until Reverse Line of Credit is Exhausted

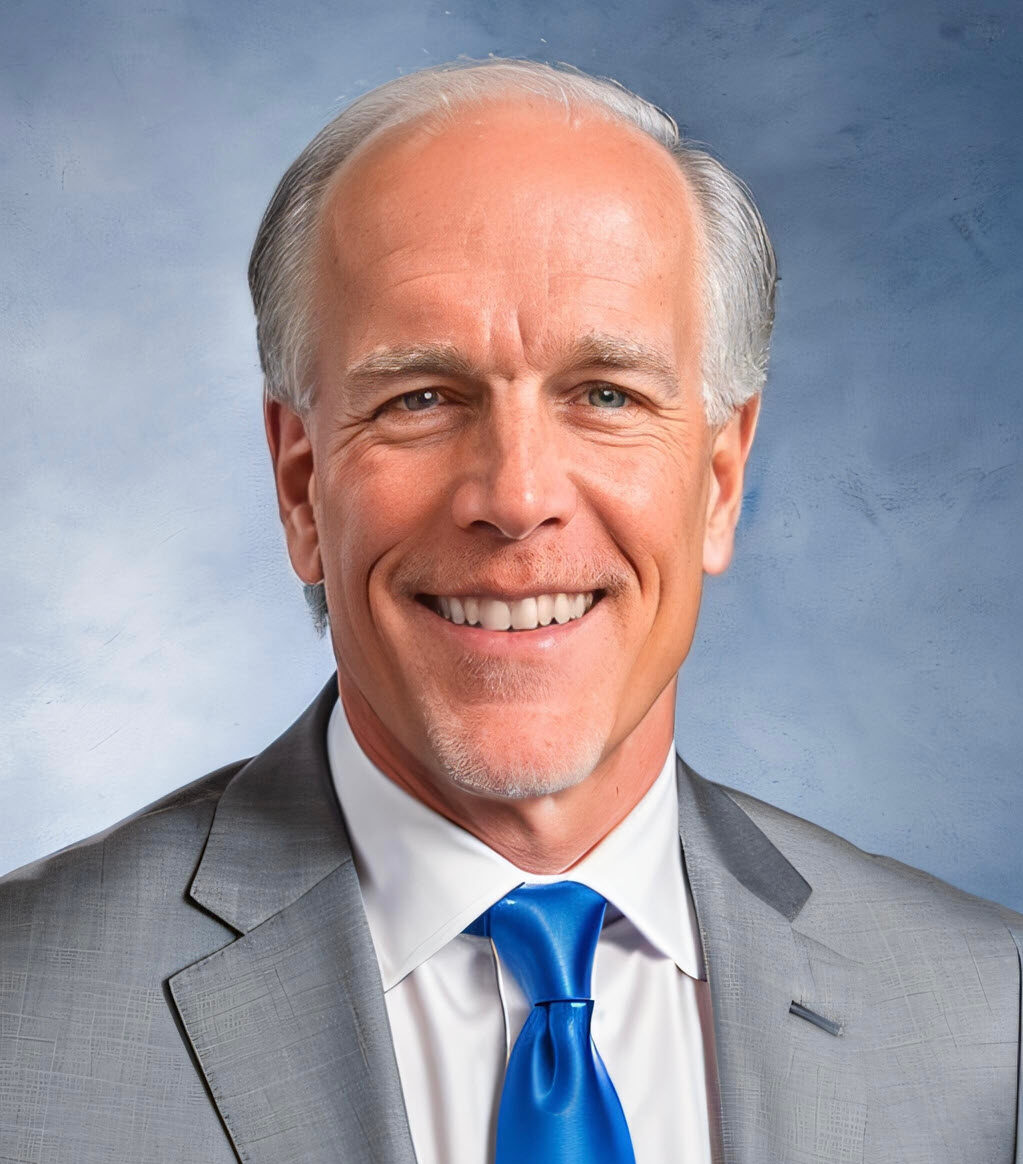

Reversing The Sequence with a Reverse Mortgage David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 By next spring, when you will both be qualified to receiver social security benefits, you’re going […]

#17 Reverse Mortgage Offers Solution for Mom and Daughter

DAUGHTER WANTS MOM INDEPENDENT David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 As an only child, daughter of a mom who was widowed 2 ½ decades ago, you were always taught […]

#16 Housing Wealth Used to Fund Whole Life Insurance

HOUSING WEALTH COMES FULL CIRCLE WHOLE LIFE David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 Before your wife of almost fifty years passed in 2020, the two of you had planned […]

#15 Reverse Mortgage Can Be Tailed to Second Marriage Situation

HOUSING WEALTH CAN FUND A SECOND LIFE David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 Yours is a story of senior dating site success – after nine years of widowhood, at […]

#14 Benefit from the Run-Up in Home Prices Without Selling

LET YOUR HOME FUNCTION AS YOUR BACKUP RESERVE FUND David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 It’s a good time to sell a home in Indiana, as you and your […]

#13 High Home Values, Low Interest Rates Increase Utility of Reverse Mortgage Line of Credit

IN COUNTDOWN TO RETIREMENT, LET YOUR HOUSING WEALTH COUNT David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 You’re the proverbial “ducks-in-a-row” type, and you’ve already begun to plan for your retirement […]

#12 Reverse Mortgage Helps Keep Retirement Assets Intact

REVERSE MORTGAGE CAN MAKE SNOWBIRDING A REALITY David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 In this, your fifth year of “semi-retirement” following 40+ year careers in the private education system, […]

#11 Reverse Mortgage Helps Pay Health Insurance Costs

REVERSE MORTGAGE TO BRIDGE THE COBRA-MEDICARE GAP David Garrison Home Equity Retirement Specialist NMLS # 1595194 Serving the State of Indiana p (317) 644-2595 c (765) 516-0130 e [email protected] 2169 East Rutland Lane, Martinsville, IN 46151 Corporate NMLS #1025894 You’ve both been employed at the same company (in different departments) for the past nineteen years. […]

#10 Paying Down Reverse Mortgage Builds Up Reserve Fund

PAYING AHEAD IN REVERSE The unusual rise in prices of residential real estate made taking out a second mortgage on your home tempting. After careful thought, though, you’ve decided to approach the issue at the other end of the spectrum. Over the coming two and a half years, you’re resolved, you’ll make “oversized” monthly payments […]