I’ve lived in the same house for decades. It’s not the biggest or the fanciest, but it’s mine. I know the way the light moves through the kitchen in the morning. I know which floorboard squeaks when I walk to the window with my coffee.

I thought paying it off would mean I could finally relax. But then life got more expensive. Groceries, prescriptions, property taxes – it all adds up.

I wasn’t in trouble, not exactly. But I found myself saying no to little things – a weekend away, a dinner out – because I couldn’t shake the feeling that I might need that money “just in case.”

One day I was sitting in my living room, the same one I’ve decorated and redecorated over the years, and I thought:

“Why am I still living like I need permission to enjoy what I’ve already built?”

That’s when I learned there’s a way for your home to return the favor – to let it take care of you for a change. Not by selling it, or moving out, or giving it up – but by letting it support the next chapter of your life.

Some people call that a reverse mortgage.

I call it giving myself room to breathe.

And honestly – that’s priceless.

How I Became Involved in Reverse Mortgages

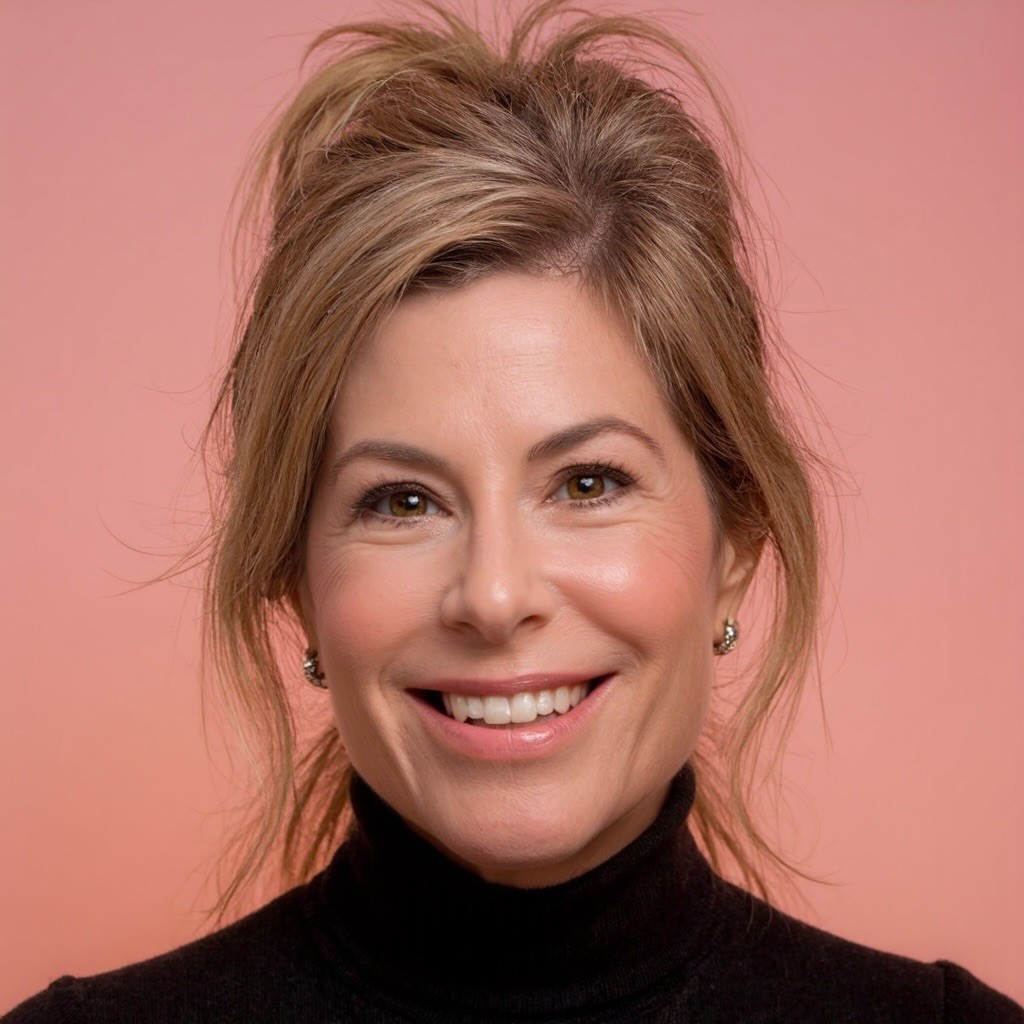

I don’t come from a traditional sales background. Like many of you, I’m a homeowner who worked for years to pay off my home. When my company downsized, I suddenly found myself out of work at 67 – three years before I’d planned to take Social Security.

Searching for solutions, I turned to my investment advisor and financial planner for guidance. Their best advice? Go back to work or drastically limit my lifestyle. When I mentioned reverse mortgages as a potential option, I hit a wall. My investment advisor dismissed them outright, saying his company doesn’t support them. My certified financial planner was equally unhelpful, explaining that his software had no way to model reverse mortgages.

That’s when I realized how profoundly misunderstood these financial tools really are.

I decided to educate myself. I dove into research – reading books and academic studies, attending webinars, and eventually finding a new certified financial planner who understood reverse mortgages. Even with a supportive team in place, I still faced significant obstacles.

My townhome community wasn’t FHA-approved, which was essential for a reverse mortgage. When the HOA board initially refused to even consider an application, I took matters into my own hands. I reached out directly to the management company to understand exactly what remediation would be needed for a single-unit approval.

Through persistent effort, I successfully worked with the community to implement the necessary changes. We facilitated a modest increase in dues to meet FHA reserve requirements, and I personally paid $34 out of pocket to ensure our insurance coverage met the required levels for the year.

The best part? While navigating all these challenges, a unit in my complex sold – boosting my own home value in the process!

This journey opened my eyes to both the potential of reverse mortgages and the barriers that prevent people from accessing this valuable financial tool.