BACKGROUND

I first discovered my love for helping seniors when I worked at a local pharmacy. Most of my customers were elderly, and I saw them almost daily. Over time, I developed close connections with a number of them. I learned that most of the seniors who visited me have lived whole and fascinating lives, and I loved hearing some of their stories, if only briefly, at the counter. I also learned that many seniors live alone or don’t have family nearby to visit or help with big tasks. This fact really pulled at my heartstrings! In 2021, I was offered a career change, putting me on an even greater path to helping seniors. I began my job as a Reverse Mortgage Assistant for one of the leading Reverse Mortgage Advisors within Mutual of Omaha. I’ve been allowed to connect on an even deeper level with older adults, help them age in place, downsize, or move closer to family.

HOW I CAN HELP

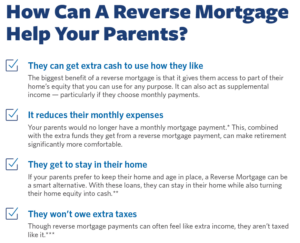

Aside from helping seniors and families navigate the loan process, my second goal is to educate the world on how helpful an FHA-insured Home Equity Conversion Mortgage, HECM (aka, a Reverse Mortgage) can be. While it is certainly not the right product for everyone (and I wouldn’t recommend it if it wasn’t!), I believe in knowing all the facts about each option a person has regarding retirement and aging with financial freedom. I offer a no-pressure environment to answer your questions and dispel some myths surrounding Reverse Mortgages. I am eager to continue helping our underserved population of seniors and provide an understanding of how a reverse mortgage could help them.

WHY ME?

As an adult child of parents who have found the retirement process a struggle, I have direct insight into what it’s like to worry about a parent’s finances. Whether you’re an aging adult looking to right-size, move closer to family, or a fellow adult child trying to find a financial solution for your parents, I can help! Let’s sit down and look over your budget, income, and savings to get a clear picture of how the equity in your family home may be able to help your retirement goals come true. An FHA-insured Reverse Mortgage can indeed be an asset!