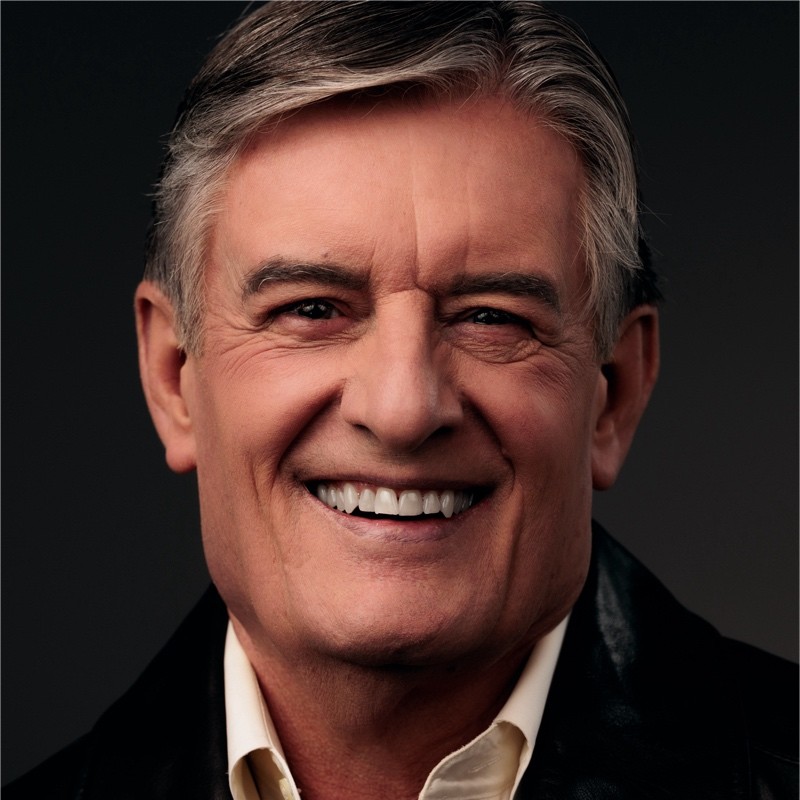

As a Home Equity Retirement originator, Steve Bell educates on utilizing housing wealth into retirement income planning. Devoted to honest and transparent dialog, Steve serves as a trusted resource for any client advisor who is needing accurate and timely housing wealth options for their clientele.

Steve works with financial institutions that are advising those in retirement, or about to retire. These include financial planners, attorneys, accountants, and wealth managers. He is adept at helping these advisors slow investment portfolio depletion and mitigate volatility risk in retirement distributions with the prudent use of the housing asset.

He also collaborates with realtors and builders who are looking to capture incremental sales by educating their clients on Mutual of Omaha’s Lifestyle Home Loan.

Recognizing the unique needs of the aging population, Steve specializes in reverse mortgages, a critical tool for many seniors seeking to utilize the equity in their homes for a better retirement life. Thousands of customers have used this financial benefit to make their retirement more comfortable, allowing them to remain in the home they know and love.

“My primary aim is always to serve my clients with utmost dedication and integrity. I’m committed to providing a sound financial solution in a respectful and ethical environment when consulting with each client.”

Steve has over 40 years of experience in mortgage origination and real estate.

Steve resides in Broken Arrow, Oklahoma near his hometown of Tulsa, and is a Vietnam Veteran, U.S. Navy. He has 4 grown children, 10 grandkids and a great-grandson.

Steve is licensed to originate loans in Oklahoma, Texas, and Iowa.

Give Steve a call directly at 918-633-8909 or fill out the form on this page to get started today! I look forward to working with you!